E Pauti Odisha Portal: Empowering citizens with online land revenue payments, managed by the Odisha Revenue.

E Pauti Odisha Portal: Empowering Citizens with Online Land Revenue Payments

The E Pauti platform is incredibly useful for completing land revenue payments in Odisha. The Odisha Revenue and Disaster Management Department is in charge of overseeing E Pauti’s official website, which is where users may access this web-based system. It’s possible that this online Odisha land revenue payment method makes it simpler for residents to make required payments from a distance, meaning they won’t have to go anywhere. The appropriate portal may be accessed by residents from any internet-connected device at odisha land revenue.nic.in. The portal is available as a mobile app from the Google Play Store in addition to this online URL. Please be aware that this page is only run by Odisha natives; anyone from other states will not find anything useful here.

Know About E Pauti

E Paut is a state of the art technology that was created by the National Informatics Centre in Bhubaneswar, Odisha, and debuted on August 5, 2020. Online land revenue payment, or “E-Pauti” as it is known locally, is the platform’s primary use. It does several tasks that residents would require, like making land tax payments easier to manage and assisting with land tax duties.

Features of E Pauti Odisha Portal

Features are one of the most important factors of the success of the platform. Given below are the list of some notable feature are:-

- The site values every individual and protects the privacy of their personal data, mainly through the use of a dependable login process.

- The user experience of the optimized app and website are both very simple to use, making it easy to access functionality.

- All smartphones can run the app and it is compatible with them.

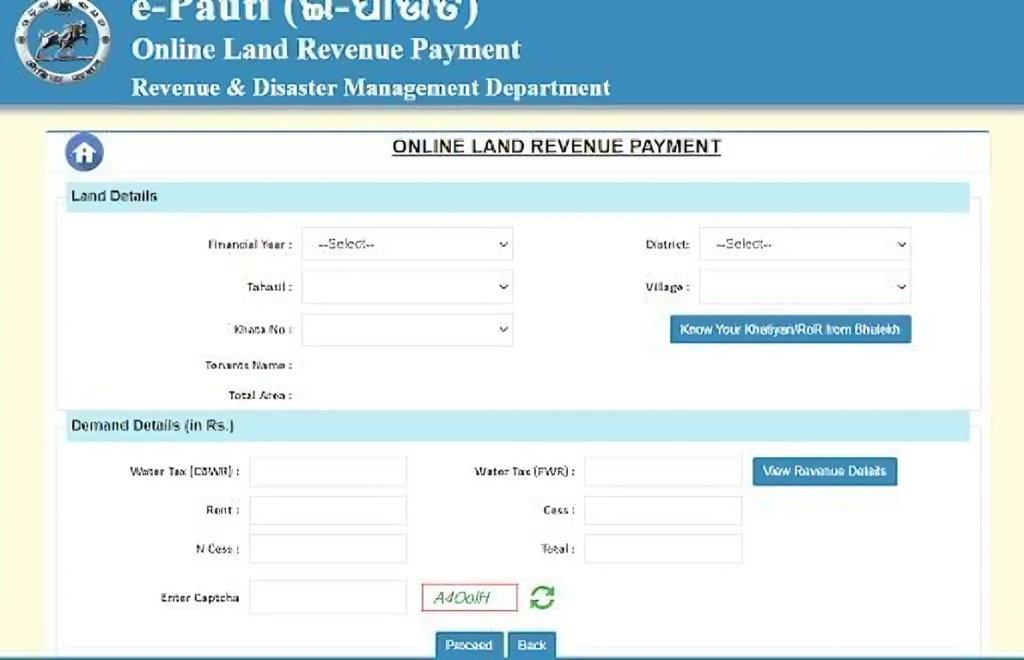

Process of Payment on E Pauti Odisha

Follow the given below step to make a payment on the E Pauti Platform are:-

- Visit the official E Pauti website at www.odishalandrevenue.nic.in using any web browser.

- There are several functions on the webpage, and “Pay Land Revenue” is one of them; click on it to continue.

- Enter all the necessary information, such as the tenant’s name, land acreage, tehsil, district, village, and financial year.

- Press “Proceed” once all the forms have been filled out.

- By selecting “Make Payment,” you can now safeguard your money and enter the depositor’s details.

- After that, the payment gateway will be reached by you. Select your preferred mode of payment and complete the transaction.

- Following payment, go to the Treasury page, click “Proceed,” and then click “Confirm” to reach the confirmation page.

- For future reference, make sure you save a copy of the Treasury Challan Reference ID and get the acknowledgement receipt.

Process to Rent Receipt From E Pauti Odisha Portal

- Once more, open your preferred web browser and navigate to the E-Pauti homepage.

- Click or tap the “rent receipt/download” option.

- Enter the transaction ID on the landing page, then click “View.”

- You will be sent by the system to a website that shows rentals in a certain format.

Process to Find Your Transaction ID

Open the app or go to www.odisharevenue.nic.in to obtain your transaction ID. To “Know Your Transaction ID,” click the link. After that, there will be a page requesting information about the village number, district, and fiscal year, among other things. Complete all required information and click “Get.” Your transaction ID will be visible on the page that appears, if all of the information you submitted is accurate.

E Pauti Mobile-optimized App

In addition to the official E Pauti Odisha website, users may use the mobile-friendly app to complete payments. For a better experience, landowners with smartphones may download the app and submit their khajana payments from anywhere at any time. If you have an iOS smartphone, you can get it from the App Store or your Android device’s Google Play Store. Additionally, the software has useful functions like:

- section responsible for handling land income payments.

- Links to download and validate rent receipts are included on the webpage.

- Citizens may quickly retrieve transaction ID and ROR by using the app.

Conclusion

E Pauti is an essential platform for land revenue payment, originating from the Odisha administration.Since its launch in the middle of 2020, it has completely changed how people make payments. Additionally, although digital land tax payers find it convenient to pay, the admin now finds it simpler to handle payments for properties located within the state thanks to the portal. Completing and starting taxes is also an easy procedure; all you need to do is adhere to the guideline provided in this post!

FAQs

What are the methods in Odisha for paying land taxes?

In Odisha, there are primarily two methods for paying land taxes: online and offline. Through its website or app, the E-pauti portal is accessed via the internet approach. In the meanwhile, you would need to go to shared service centers, or CSCs, to make offline payments.

Is There an App for the E-Pauti Portal?

Indeed, a mobile app for the E-Pauti portal is available to increase convenience and e-accessibility.

What Fees Does E Pauti Odisha Portal Charge?

No, E Pauti Odisha does not impose any fees on its customers; it is a free service. It is advisable that you verify whether there is a transaction fee associated with the chosen payment method at the same time.

How does one go about getting a rent receipt from E-Pauti?

You may obtain the rent receipt by clicking on the link on the official E Pauti Odisha webpage. Go to the page, fill out the form, and press “view.” When necessary, download and utilize the generated file.